nebraska sales tax calculator by address

So whilst the Sales Tax Rate in. Or Choose Cost Includes Sales Tax which means the figure you entered at step 2 is the gross amount for the goods service and the calculate will calculate and deduct the relevant Sales.

Sales Tax Calculator Credit Karma

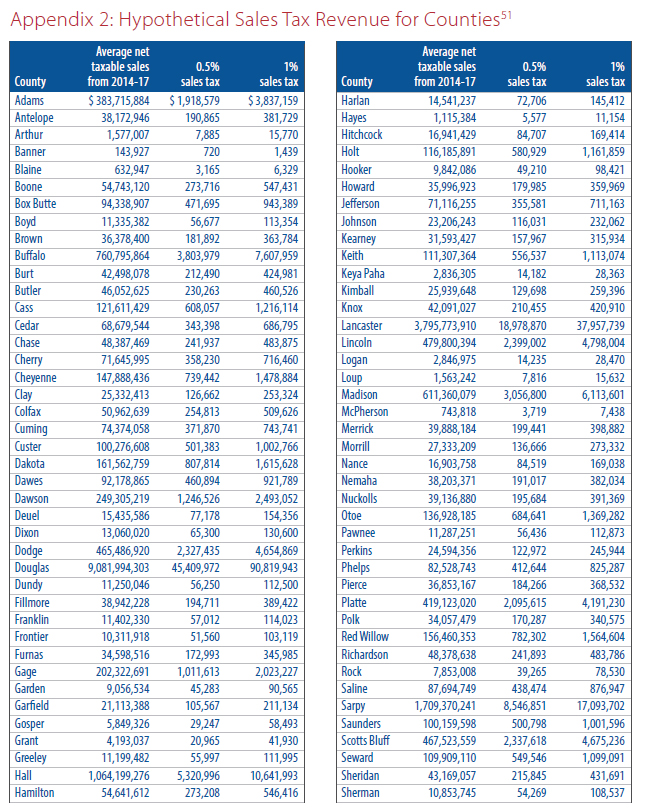

Local tax rates in Nebraska range from 0 to 2 making the sales tax range in Nebraska 55 to 75.

. How to Calculate Nebraska Sales Tax on a Car. When you enter the street address the calculator uses geolocation to pinpoint the exact tax jurisdiction. Enter the total dollar amount of ALL Nebraska sales leases rentals and services made or facilitated by your business or by an MMP on your behalf.

55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska Jurisdictions with. Find your Nebraska combined state. The Nebraska state sales and use tax rate is 55 055.

The sale and delivery of aircraft to a purchaser in Nebraska is subject to the Nebraska and local sales or use tax unless a specific exemption applies. You can use our Nebraska Sales Tax Calculator to look up sales tax rates in Nebraska by address zip code. As far as cities towns and locations go the place with the highest sales tax rate is Beatrice and the place with the lowest sales tax rate is Abie.

Please ask your organization administrator to assign you a user type that includes Essential Apps or an. Nebraska has recent rate changes Thu Jul 01 2021. L Local Sales Tax Rate.

So no matter if you live and run your business in Nebraska or live outside Nebraska but have nexus there you would charge sales tax at the rate. The Nebraska Sales Tax Rates Calculator will help you identify the correct sales tax rate to charge for any location in Nebraska. Sr Special Sales Tax Rate.

The Nebraska NE state sales tax rate is currently 55. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective January 1 2023 Updated. With local taxes the total sales tax rate is between 5500 and 8000.

Simply enter the 5-digit zip code of the location. The local sales or use tax due is. This includes the rates on the state county city and special levels.

The average cumulative sales tax rate in Lincoln Nebraska is 719 with a range that spans from 55 to 725. Depending on local municipalities the total tax rate can be as high as 75 but food and prescription drugs are exempt. From there it can determine the corresponding sales tax rate by accessing.

The state sales tax rate in Nebraska is 5500. The calculator will show you the total sales tax. Nebraska Department of Revenue PO BOX 94818 Lincoln NE 68509-4818.

S Nebraska State Sales Tax Rate 55 c County Sales Tax Rate. The Nebraska state sales and use tax rate is 55 055. Just enter the five-digit zip.

Nebraska is a destination-based sales tax state. For example lets say that you want. Nebraska Sales Tax Calculator.

You can calculate the sales tax in Nebraska by multiplying the final purchase price by 055. Nebraska State Office Building 301 Centennial Mall S Lincoln NE 68508. The base state sales tax rate in Nebraska is 55.

The most populous zip code in Nebraska is. Your account is not licensed to use an app that is not public. Sales Tax Rate s c l sr.

Kansas Department Of Revenue Pub Ks 1510 Sales Tax And Compensating Use Tax

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

2022 Real Estate Capital Gains Calculator Internal Revenue Code Simplified

Nebraska Sales And Use Tax Nebraska Department Of Revenue

How To Calculate The Nebraska Sales Tax On Cars Woodhouse Nissan

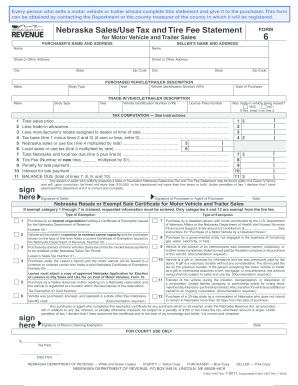

Nebraska Vehicle Sales Tax Form Fill Out And Sign Printable Pdf Template Signnow

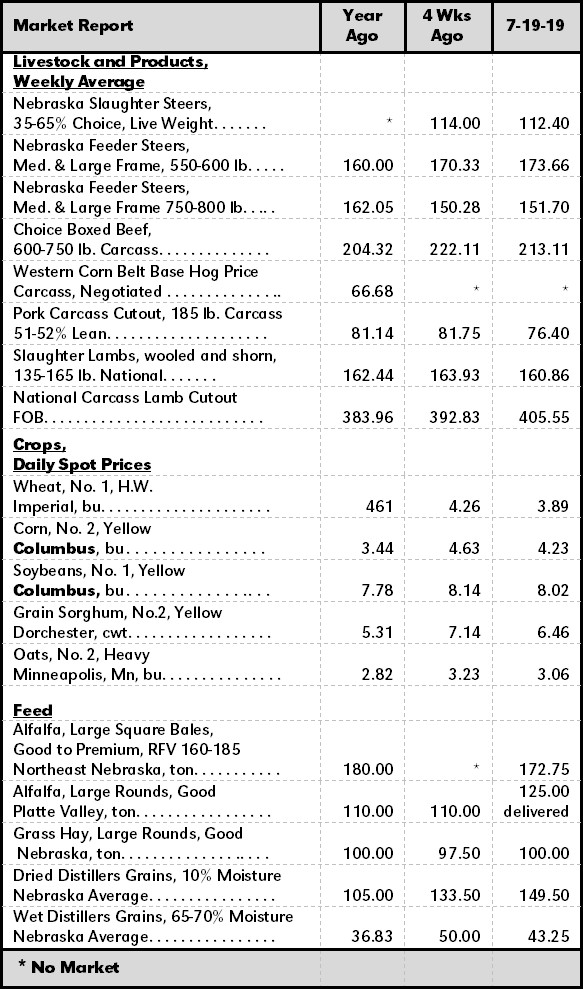

2019 Nebraska Property Tax Issues Agricultural Economics

Get Your 2022 2023 Nebraska State Income Tax Return Done

How To File And Pay Sales Tax In Nebraska Taxvalet

Sales Tax Calculator Find Rates In Your Area Now Quickbooks

Free Nebraska Payroll Calculator 2022 Ne Tax Rates Onpay